New Mortgage Fees

Borrowers with a Higher Credit Score Pay More

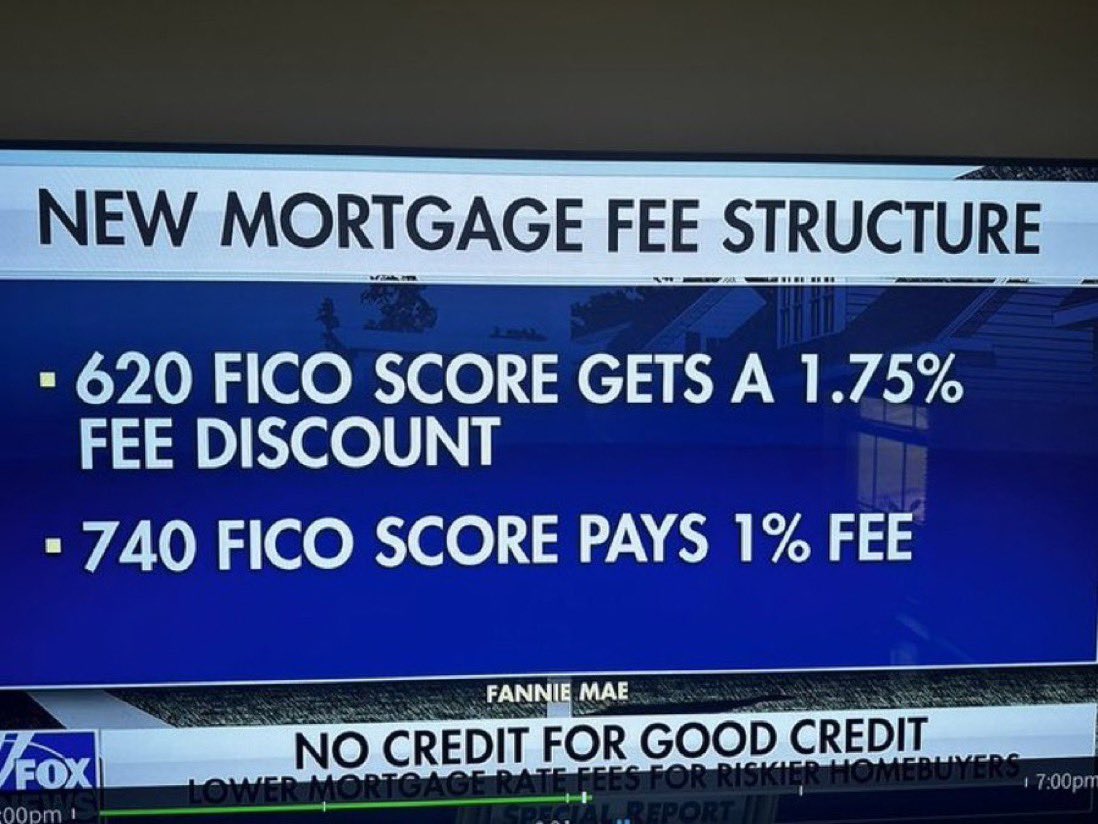

Everyone is talking about the new mortgage fees that seem to “punish borrowers with a higher credit score and offer a discount to riskier borrowers”. So, what is the truth about these fees and how will they affect you?

Fannie Mae and Freddie Mac announced the new loan fees in January, but the general public has only started hearing about these changes recently. The fee changes apply to the loan-level price adjustments (LLPAs) imposed by Fannie Mae and Freddie Mac, the two entities that guarantee a vast majority of new mortgages. LLPAs are based on loan features such as your credit score and the loan-to-value among other things. They’ve changed several times over the years, but this was a fairly substantial change compared to the past.

What is a Loan-Level Price Adjustment?

In 2008, as government-backed loans began going bad, Fannie Mae and Freddie Mac realized they were undercapitalized and overexposed to risk.

Both organizations were losing money, so they decided to increase fees. As some loans were less risky than others, they didn’t want to make an across-the-board fee change, and the loan-level pricing adjustment was born.

Loan-level pricing adjustments are literally adjustments to the “price” of a loan. They are the government’s way of raising prices for “riskier” borrowers without putting a penalty on “safer” ones. Just like auto insurance, a person loaded with risk will typically pay a higher premium.

Will Borrowers with Higher Credit Scores Pay More?

In many cases yes – The revised LLPA pricing structure increases fees for many borrowers with high credit scores (680 and above) and reduces fees for most borrowers with a score lower than 680. The biggest increase affects borrowers with a credit score of 680 or higher who make a 15-20% downpayment. All borrowers paying 5% or less as a down payment will see lower LLPAs regardless of credit score. The result is more favorable mortgage rates for buyers with a credit score lower than 679 and smaller down payments than under the previous system.

Ultimately, borrowers with lower credit scores will still pay more fees than those with higher scores, so don’t go skipping those credit card payments in the hopes of getting a lower rate. This new structure shrinks the gap and reduces the “penalty” for having a score under 680.

At the time of writing this article, a coalition of fiscal officers from 27 state governments called on the Biden administration and the Federal Housing Finance Agency (FHFA) to scrap the loan-level pricing adjustment (LLPA) fee changes.

In a letter to President Joe Biden and FHFA Director Sandra Thompson, the fiscal officers said the new policy will force homebuyers with good credit to pay more on their mortgage every month. “Those who make down payments of 20% or more on their homes will pay the highest fees – one of the most backward incentives imaginable,” the letter said.

An Example of the New Fee Structure

640-659 Credit Score 20-25 percent down payment. You now pay a fee equal to 2.25 percent of the loan balance. Before these changes, the same borrower paid a 3 percent fee. On a hypothetical $350,000 loan, that’s a savings of $2,813

740-759 Credit score 20 percent down payment. You would have paid a fee of 0.5 percent with an 80 percent loan-to-value (LTV) ratio. Under the new rules, that fee rises to 0.875 percent. On a $350,000 loan, that’s an extra cost of $1,313

Fees went up for a borrower with a higher credit score and down for a borrower with a lower credit score.

If you have any questions on how these new fees will affect you or want more information, please don’t hesitate to contact me and I will put you in touch with one of my top lenders.