Current Real Estate Market Conditions

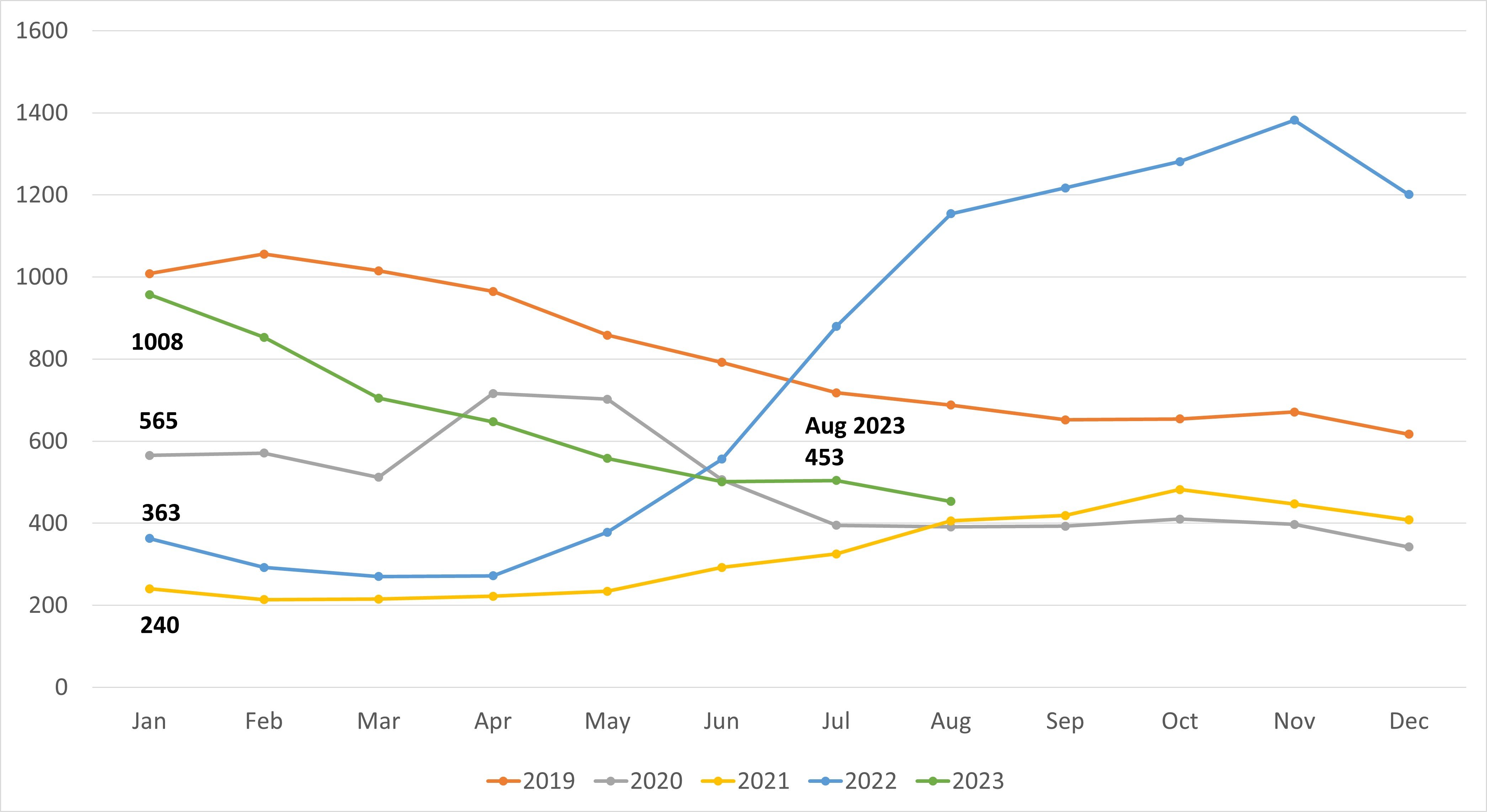

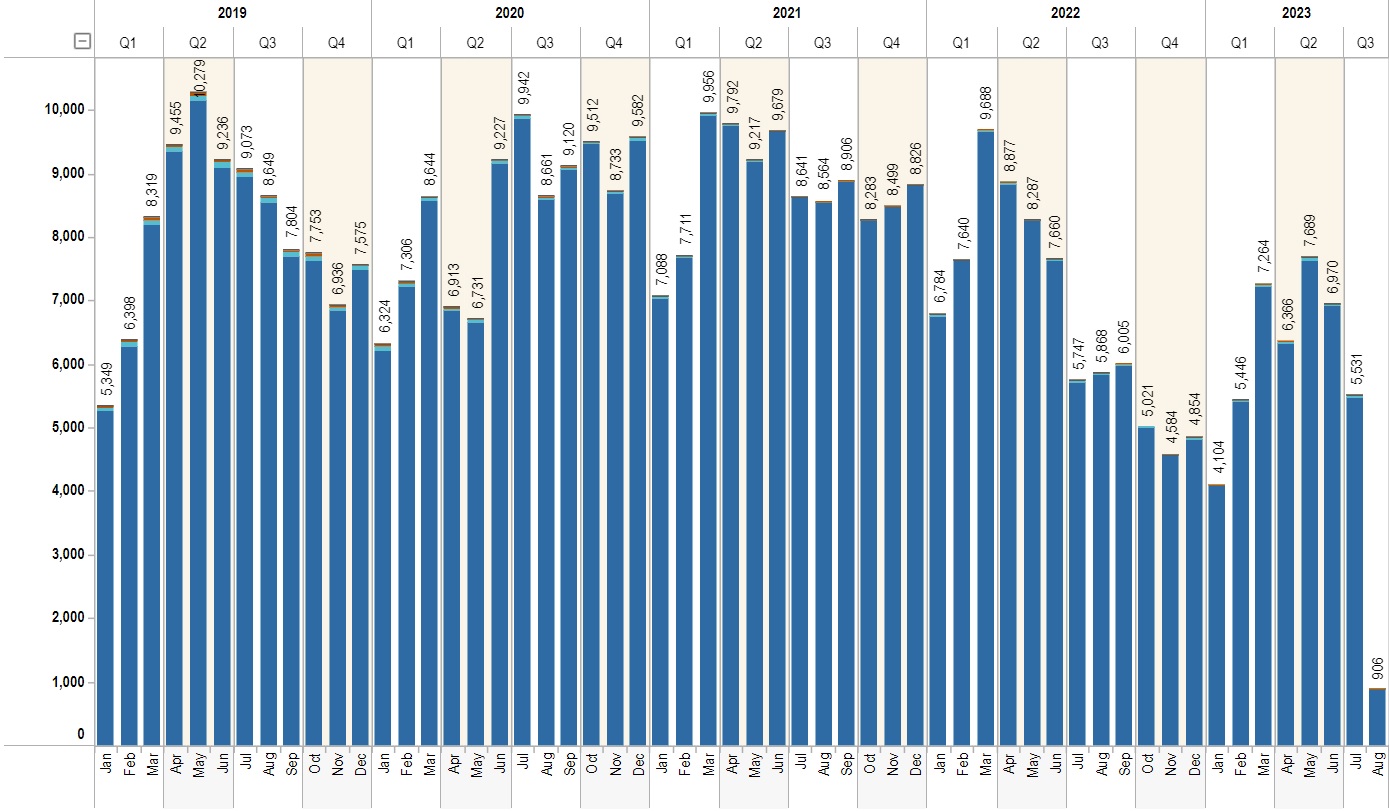

The real estate market is pretty slow right now with low demand and even lower supply. The interest rates certainly aren’t helping however, we are still seeing multiple offers in the under $600,000 price point, and homes that are priced well and not overpriced are selling fast. Hopefully, as we head into September and the cooler weather we will see things start to tick up again.

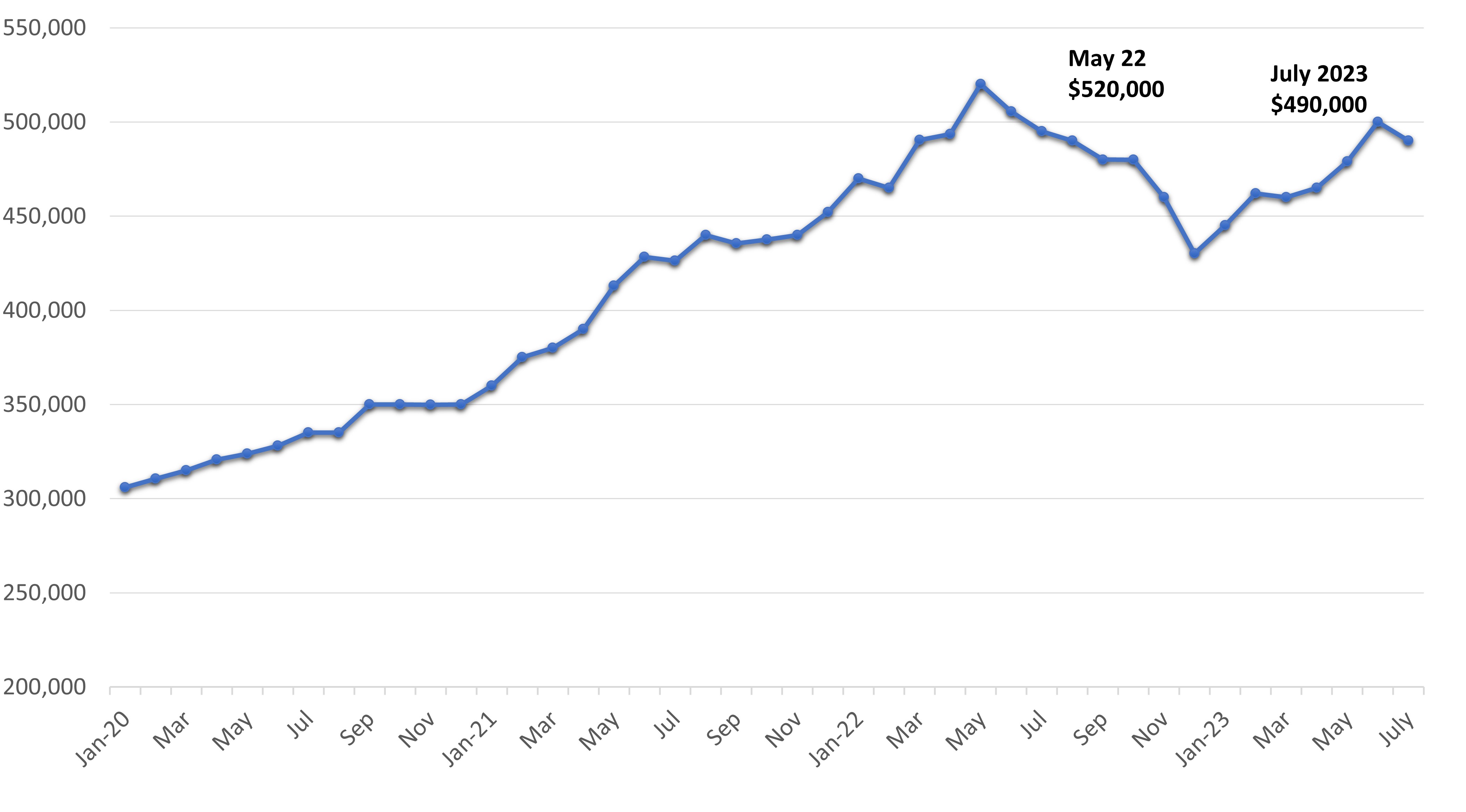

There are still those who think there is a bubble and the real estate housing market is going to crash but there is nothing to indicate this. It’s a simple supply and demand scenario with prices only coming down once we have excess supply compared to demand. Even though our demand is very weak right now, supply is far weaker, and with more demand than supply, prices will continue to stay up.

I have heard people talk about the delinquency rate and expect that to increase and start the downturn of the market, but again there is no sign that is going to happen and we have a very low delinquency rate.

Until we see a reversal in the current trend and supply outpaces demand, prices are going to continue to stay strong and very likely to go up in the spring. If you are a buyer, you might want to consider purchasing between now and the end of the year to get the best price, if interest rates come down next year you can refinance at that time but at least you have locked into a home at a lower price.

Statistics from the Cromford Report