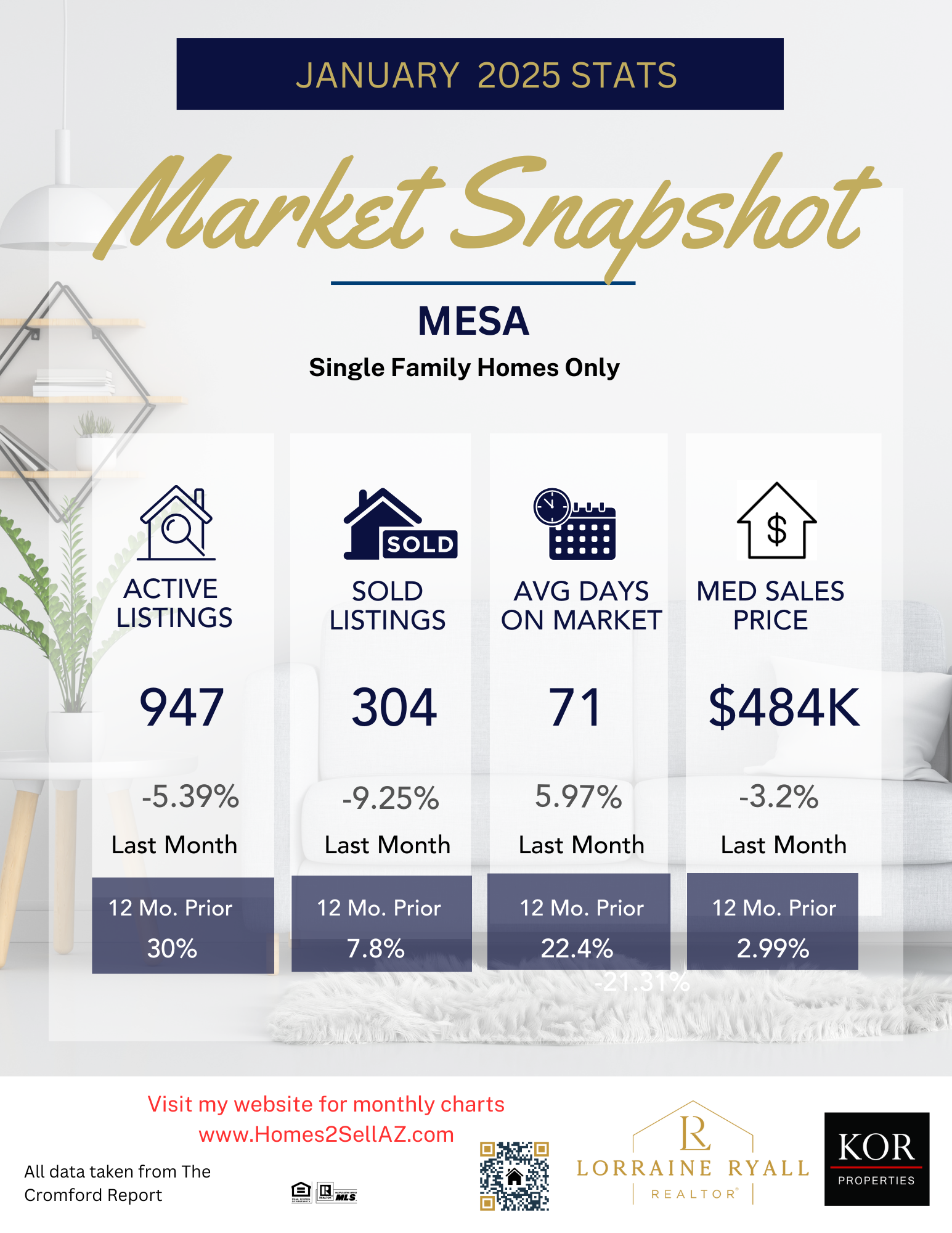

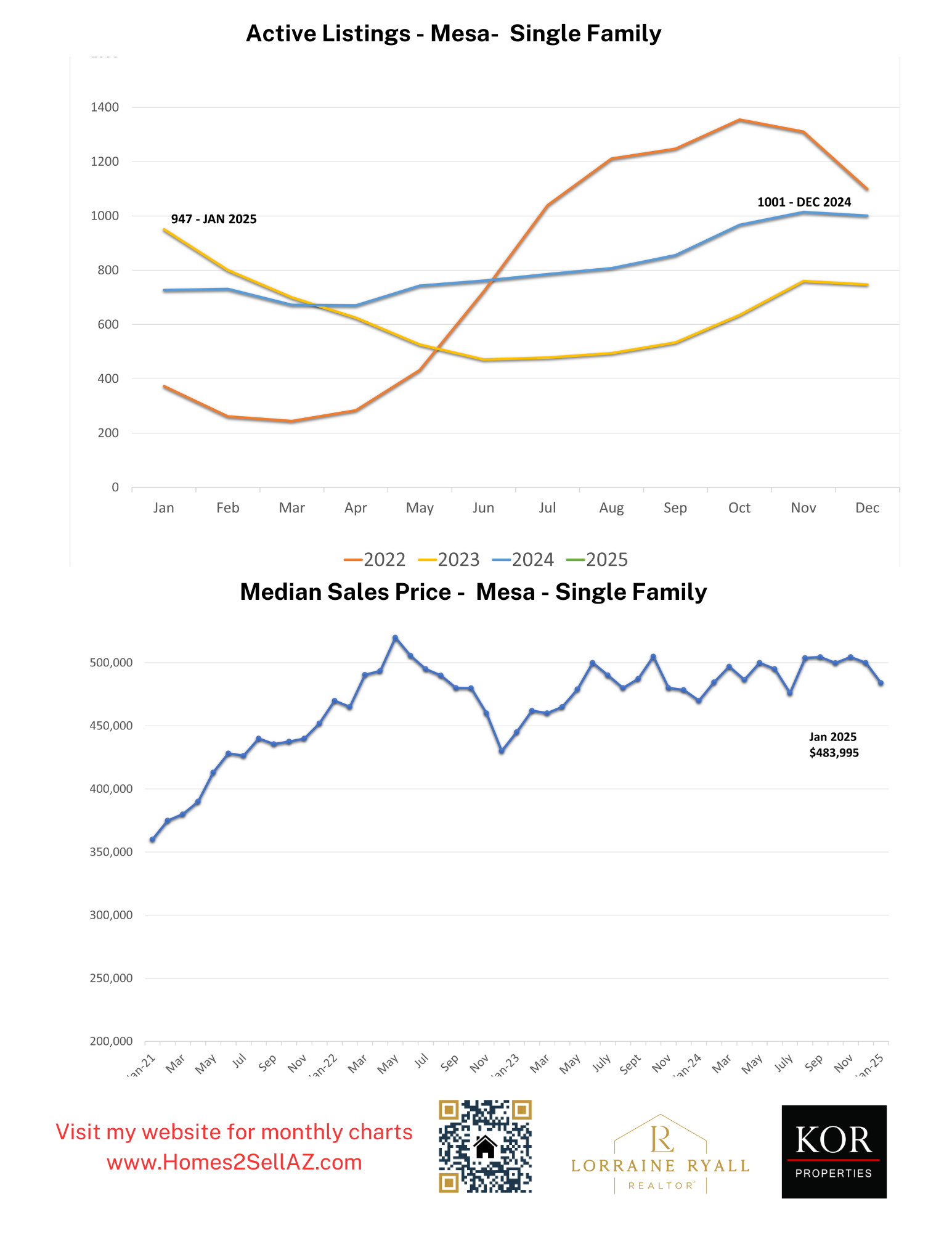

Supply and sales saw a slight dip last month, with Days on Market increasing to 71 days, up 22% from January 2024.

We are off to a bit of a slow start. Although interest rates are off their highs, the key 30-year fixed rate is still a little over 7% and the Federal Reserve has little appetite for further cuts. At this stage, there seems to be more chance that buyers will have to get used to these rates than there is of rates coming down significantly. If we do see any significant rate drop expect the buyers to all come out at once. At some point all the buyers who have been sitting on the sidelines are going to come out and start buying even if we don’t see rates drop, it’s just a matter of when.

In spite of more supply and less demand we are not seeing prices coming down. The average price per sq. ft. has risen a colossal 8.4% over the past 2 months and 8.8% over the past year. Almost all the annual increase has happened in the last 2 months.

The luxury market has been on fire over the last 2 months with closed sales up dramatically compared with a year earlier. The higher up the price range you go, the more startling the increase in sales volumes.

by Lorraine Ryall

Associate Broker with KOR Properties